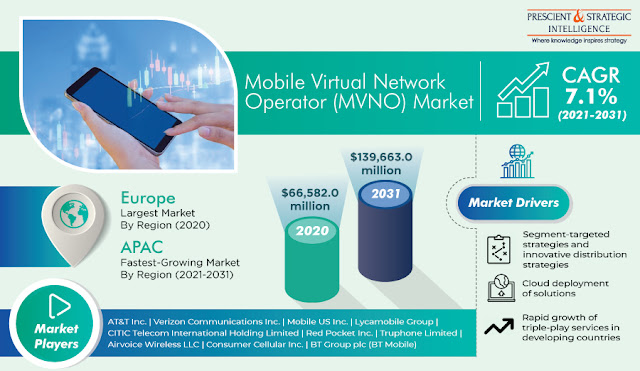

A number of factors such as the surging demand for low-cost mobile services and penetration of mobile devices, increasing need for triple-play services in emerging economies, segment-targeted pricing and innovative distribution strategies, and rising requirement for high-speed internet connectivity across the world are expected to drive the growth of the mobile virtual network operator (MVNO) market at a CAGR of 7.1% during the foreseeable period (2021–2031).

According to P&S Intelligence, the market size is projected to reach $139,663.0 million by 2031 from $66,582.0 million in 2020. The increasing need for triple-play services in emerging economies is one of the main factors boosting the growth of the MVNO market. Service providers offer triple-play services consisting of television, broadband internet access, and latency-sensitive telephone services.

The triple-play services concept is widely accepted in North America. Thus, telecom operators are progressively providing these services to retain more customers and offer better value in the region. It is expected that triple-play services will be delivered across the globe through internet in the coming years. Therefore, the need for bundled packs is rising.

Based on service type, the MVNO market is classified into discount, media & entertainment, telecom, retail, business, migrant, cellular machine-to-machine (M2M), and roaming. Out of these, the cellular M2M category is expected to witness the fastest growth during the forecast period. This can be ascribed to the advancements in the 3G M2M technology; rise in the adoption of cellular connectivity in all types of machines, ranging from vending machines to vehicles; and extension of mobile network coverage.

Thus, the surging need for triple-play services and the rising demand for low-cost mobile services and penetration of mobile devices across the world are projected to propel the market growth in the coming years.

According to P&S Intelligence, the market size is projected to reach $139,663.0 million by 2031 from $66,582.0 million in 2020. The increasing need for triple-play services in emerging economies is one of the main factors boosting the growth of the MVNO market. Service providers offer triple-play services consisting of television, broadband internet access, and latency-sensitive telephone services.

The triple-play services concept is widely accepted in North America. Thus, telecom operators are progressively providing these services to retain more customers and offer better value in the region. It is expected that triple-play services will be delivered across the globe through internet in the coming years. Therefore, the need for bundled packs is rising.

Based on service type, the MVNO market is classified into discount, media & entertainment, telecom, retail, business, migrant, cellular machine-to-machine (M2M), and roaming. Out of these, the cellular M2M category is expected to witness the fastest growth during the forecast period. This can be ascribed to the advancements in the 3G M2M technology; rise in the adoption of cellular connectivity in all types of machines, ranging from vending machines to vehicles; and extension of mobile network coverage.

Comments

Post a Comment