With the increasing costs of maintaining private data centers and the generation of large but inconsistent volumes of data, enterprises are increasingly preferring renting data centers, which are also known as colocation data centers. For instance, the development of a private data center facility can cost as much as $200 per square foot, excluding the $10,000 per mile cost of setting up fiber cabling.

Get the Sample Copy of this Report @ https://www.psmarketresearch.com/market-analysis/data-center-colocation-market/report-sample

Unlike large organizations, small and medium enterprises (SMEs) cannot afford such high costs. Moreover, the SMEs that use cloud computing solutions do not need to make these kinds of huge investments. This is why the demand for data colocation centers is rising sharply.

Furthermore, the increasing adoption of advanced technologies such as the internet of things (IoT) and artificial intelligence (AI) and rapid digitization of business operations are also resulting in the generation of large volumes of data that need to be cost-effectively and efficiently managed and securely stored.

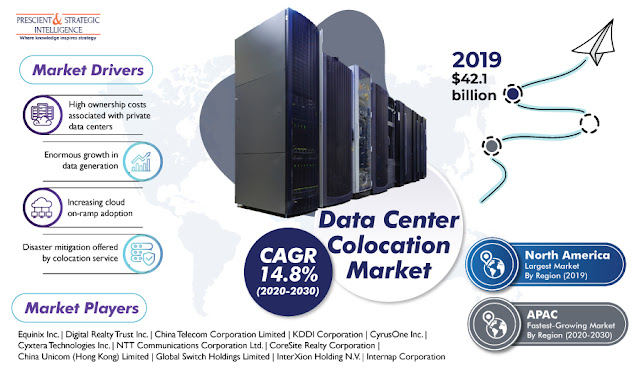

Owing to the aforementioned factors, the revenue of the data center colocation market reached $42.1 billion in 2019, while the market will advance at a CAGR of 14.8% from 2020 to 2030. In simpler terms, a data colocation center is any large data center that rents out space to various third parties for their network equipment and servers.

Depending on type, the market is divided into wholesale colocation and retail colocation categories. Between these, the wholesale colocation category is predicted to register faster growth in the market in the coming years. This is credited to the soaring demand for large storage spaces and the increasing adoption of cloud solutions by large organizations for efficient data management and storage.

Comments

Post a Comment