Enterprises can deploy aPaaS on public, private, or hybrid cloud. In recent years, the organizations have shown a high preference for hybrid cloud for sharing data and apps between various clouds. Moreover, escalating popularity of hybrid cloud deployment mode can be credited to the rising adoption of multiple cloud services to curtail cost and the burgeoning demand for enhanced productivity and efficiency through centralized cloud governance.

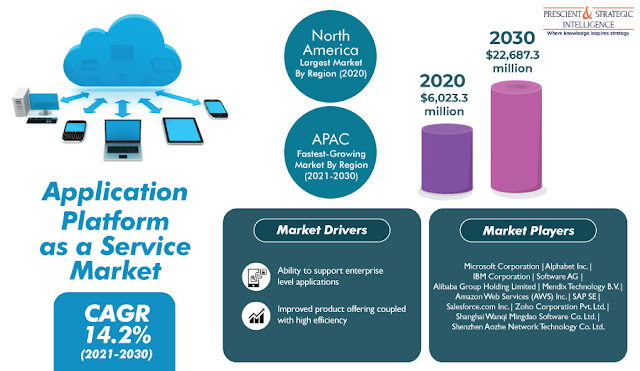

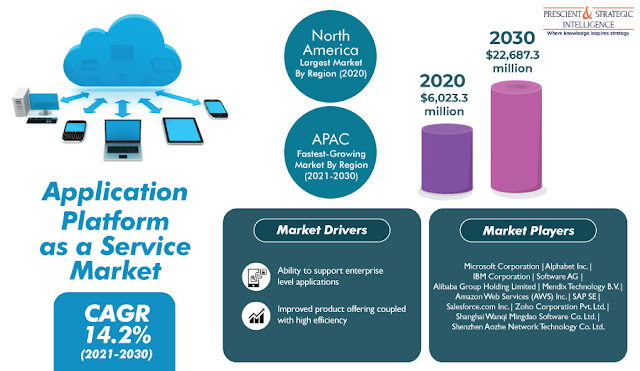

Owing to these features, this deployment mode will witness the highest adoption in the coming years. Large enterprises and SMEs can procure aPaaS solutions from key players such as Microsoft Corporation, Shenzhen Aozhe Network Technology Co. Ltd., Mendix Technology B.V., Amazon Web Services (AWS), IBM Corporation, Zoho Corporation Pvt. Ltd., Software AG, Alphabet Inc., Salesforce.com Inc., Shanghai Wanqi Mingdao Software Co. Ltd., and Alibaba Group Holding Ltd.

Owing to these features, this deployment mode will witness the highest adoption in the coming years. Large enterprises and SMEs can procure aPaaS solutions from key players such as Microsoft Corporation, Shenzhen Aozhe Network Technology Co. Ltd., Mendix Technology B.V., Amazon Web Services (AWS), IBM Corporation, Zoho Corporation Pvt. Ltd., Software AG, Alphabet Inc., Salesforce.com Inc., Shanghai Wanqi Mingdao Software Co. Ltd., and Alibaba Group Holding Ltd.

Get the Sample Copy of this Report @ https://www.psmarketresearch.com/market-analysis/application-platform-as-a-service-market/report-sample

These companies are recently focusing on product launches, partnerships, and mergers and acquisitions to stay ahead of their competitors. According to P&S Intelligence, North America was the largest consumer of aPaaS solutions in the past, owing to the high expenditure on cloud-enabled services by business organizations. Additionally, the spurring demand for information technology (IT) solutions that provide scalability, agility, reduced time and cost, and pay-per-use-based pricing will also fuel the deployment of aPaaS solutions in the coming years.

Whereas, the Asia-Pacific aPaaS market will advance at the highest pace in the foreseeable future, due to the surging adoption of cloud computing in the manufacturing and retail industries in India, China, and Australia. Thus, the booming demand for flexibility and scalability in application development and the surging demand for customization of enterprise-level applications will amplify the usage of aPaaS solutions in the coming years.

Whereas, the Asia-Pacific aPaaS market will advance at the highest pace in the foreseeable future, due to the surging adoption of cloud computing in the manufacturing and retail industries in India, China, and Australia. Thus, the booming demand for flexibility and scalability in application development and the surging demand for customization of enterprise-level applications will amplify the usage of aPaaS solutions in the coming years.

Comments

Post a Comment